10. doral bank

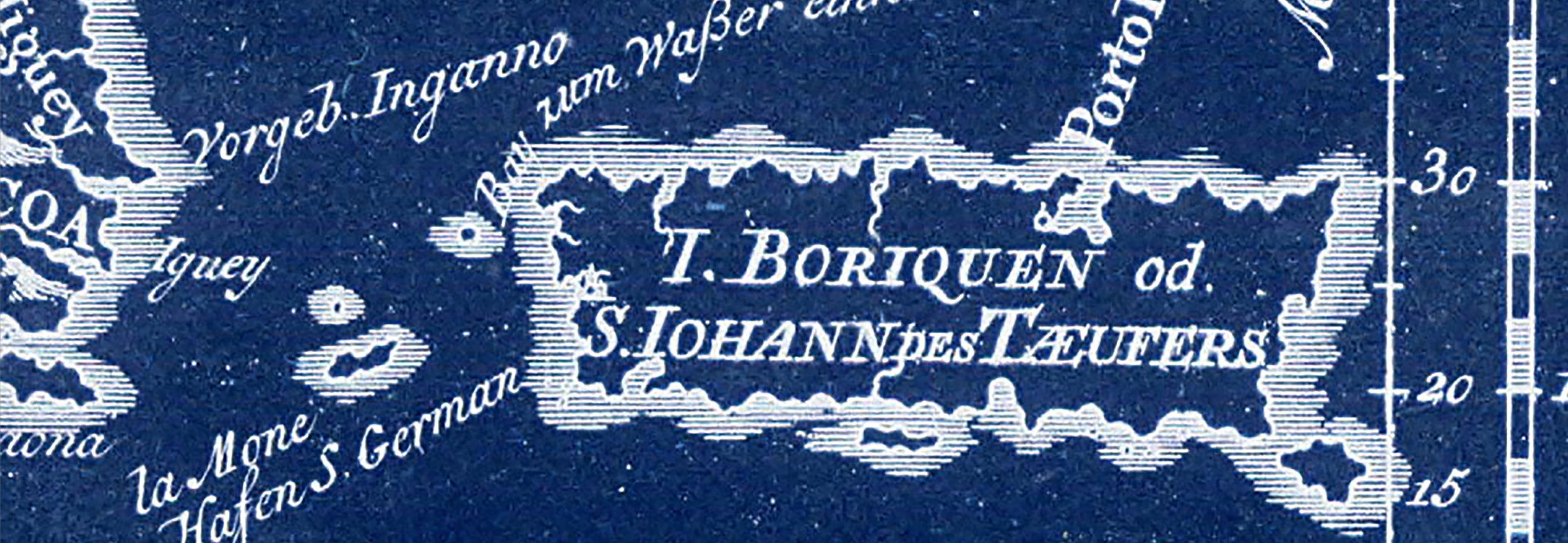

Image credit Bemba PR, Puerto Rican artivist group, used with permission.

DORAL BANK

The failure of Doral Bank (Doral Financial) in 2014-2015 was a key turning point in the story of the Puerto Rico debt crisis, culminating with the bipartisan passage in Congress of PROMESA (Public Law No: 114-187) on June 29, 2016 and President Obama’s signature on June 30, 2016. A lot has been written about the Puerto Rico bonds that played a major part in the accumulation of public debt. The failure of Doral Bank doesn’t receive as much attention in bank fraud analyses regarding Puerto Rico. “It was the largest bank failure in the United States in 2015 and the 30th largest bank failure in American history.”

Just recently, a story of another Puerto Rico bank that failed, Westernbank, came out, it barely got any mention.

Pharma exec who destroyed own firm and Puerto Rico bank sentenced to 30 years

By Jay Weaver, Miami Herald, July 03, 2019

“The 46-branch Westernbank, based in San Juan, incurred more than $100 million in loan losses and was closed by regulators in 2010, when the Federal Deposit Insurance Corporation reached an agreement for Banco Popular de Puerto Rico to assume its deposits.”

Why do I think this analysis of something that happened 4-5 years ago is important? Because we’re already seeing signs of a similar pattern in 2019 of how global capital and U.S. politicians are setting the stage to continue to completely consolidate power to control Puerto Rico, always at the expense of the populace at large.

Doral Bank was a family-owned business started by Salomon Levis in 1972. After an SEC investigation in the early 2000s, a new CEO, Glen R. Wakeman was named in 2006 and in 2007 it was sold to Bear Stearns, Goldman Sachs, and a group of hedge funds.

Of course Bear Stearns was a central player in 2008 foreclosure crisis.

Wall Street’s Naked Swindle

By Matt Taibbi, Rolling Stone, April 5, 2010

Everything You Need to Know About Wall Street, in One Brief Tale

By Matt Taibbi, Rolling Stone, January 13, 2012

Banco Popular (and other banks such as FirstBank and Centennial Bank) picked up the bulk of Doral Bank’s assets after its failure. José Carrión III, a member of the Banco Popular dynasty, is the chair of the Puerto Rico Financial Oversight Management Board (FOMB or “La Junta”), the dictatorial un-elected board that emerged from PROMESA. His cousin, Richard Carrión, is the Chairman of Banco Popular. José Carrión’s many other conflicts of interest have been covered extensively by Hedge Clippers: HEDGE PAPER NO. 65: Insured to Profit: Conflicts of interest in the career of José Carrión III

In 2018, the FDIC sued 16 banks in connection to Doral Bank’s demise, including Bank of America Corp., Citigroup Inc., Credit Suisse Group AG and JPMorgan Chase & Co. in connection to the LIBOR rate manipulation scheme. If large banks were responsible for Doral Bank’s failure, why is the narrative about Puerto Rico’s debt, in both “mainland” and island media, centered almost exclusively on local corruption?

Doesn’t this indicate that much more powerful global capital forces are at play, but somehow these escape the “corruption” label?

(Various relevant articles linked along the timeline, with additional articles on Doral Bank at the bottom.)

______________

TIMELINE

2001-2005 SEC investigation due to Doral Bank malfeasance due to stock manipulation.

2006

Doral Bank names Glen R. Wakeman president and COO

2007 Doral Bank sold to Bear Stearns, and a group of hedge funds, Marathon Asset Management, Perry Capital, the D. E. Shaw group, Tennenbaum Capital Partners, Eton Park Capital Management, Goldman Sachs & Co., Canyon Capital Advisors and GE Asset Management.

Doral Announces Recapitalization Plan and Related Equity Investment

May 17, 2007

______________

2008

Indicted Ex-Doral Exec: Why Me?

By Ruthie Ackerman

Mar 6, 2008

“Federal prosecutors allege that the former treasurer of Puerto Rico's largest mortgage lender committed fraud; he says he's only a scapegoat for the mortgage industry mess.

Mario S. Levis, former treasurer of Doral Financial , was indicted Thursday on securities fraud and three counts of wire fraud. Doral's shares fell 0.4%, or 7 cents, to close at $18.89.

The U.S. Attorney's Office for the Southern District of New York accuses Levis of defrauding investors between 2001 and 2005 by manipulating the reported value of the company's core assets to artificially inflate the market price of Doral's common stock.

Meanwhile, Roy Black, Levis' attorney said his client adamantly denies the allegations. While the mortgage market has faced turmoil in the past few years, Black questions why Doral and Levis have been "singled out." He goes on to compare Doral's problems to those of Citigroup and Fannie Mae, which both had losses of billions of dollars in the fourth quarter of 2007.”

(Coincidentally, Roy Black was part of Jeffrey Epstein’s legal team.)

______________

2010

Ex-Doral bank exec sentenced to 5 years for fraud

Reuters, November 16, 2010

“Doral was sold in 2007, averting a possible bankruptcy. It has paid a $25 million fine to the U.S. Securities and Exchange Commission and settled investor lawsuits for $129 million.”

The case is U.S. v. Levis, U.S. District Court, Southern District of New York, No. 08-00181.

______________

2011

Murder of Maurice Spagnoletti, executive vice president of Doral Bank in Puerto Rico.

(The “santería” angle injected into this story, while entertaining, seems like a nice sensationalistic way to distract from the larger aspect of bank fraud.)

The Strange Story of a Murdered Banker in Puerto Rico

Bloomberg, By Zeke Faux, July 6, 2016

“Spagnoletti, 57, was the No. 2 executive at Doral Bank in San Juan, Puerto Rico. Once flush, the bank had been almost ruined by a fraud scandal, and in 2007 it was rescued by Bear Stearns, Goldman Sachs, and a group of hedge funds. The Wall Street investors had put up $610 million, but Doral continued to lose money, and they were losing patience. In late 2010, Doral hired Spagnoletti, a New Jerseyan experienced in managing large banks, with orders to reduce costs and get Puerto Rican operations under control.”

______________

2012

PR Hacienda (Puerto Rico Treasury Department) agrees to refund Doral Bank in overpaid taxes, agreement made during the PNP Governor Luis Fortuño’s last year in office. (PR statehood party, GOP).

By Julio Varela

(also why is Roger Stone writing about Luis Fortuño?)

November 2012 — Luis Fortuño loses gubernatorial election to PPD (Commonwealth) candidate Alejandro García Padilla.

______________

2014

June 28, 2014 Governor García Padilla signs into law the Puerto Rico Public Corporation Debt Enforcement and Recovery Act (Ley de Quiebra Criolla), a Puerto Rico Bankruptcy Law. The PR Commonwealth is immediately sued by Franklin Advisers and Oppenheimer Funds. This case reaches the US Supreme Court in June 2016, Puerto Rico v. Franklin Trust, which Puerto Rico lost.

JUNE 2014 — Doral Financial Corp. v. Commonwealth of Puerto Rico lawsuit

Doral Wants Puerto Rico to Pay $229.9 Million Tax Refund

Bloomberg, Sophia Pearson, June 5, 2014

Koch Brothers and Doral Bank-linked launch a campaign with lobbying firm DCI Group to discredit Puerto Rico’s governor at the time, Alejandro García Padilla. DCI Group bought full page ads in U.S. newspapers comparing García Padilla to Argentina’s former president Cristina Fernández de Kirchner and Venezuela’s Nicolás Maduro.

Puerto Rico: Slouching Towards Venezuela — American Future Fund ads in Wall Street Journal in 2014

Puerto Rico: Argentina of the Caribbean — American Future Fund ads in Wall Street Journal in 2014

American Future Fund Goes to the Islands

By Viveca Novak, September 12, 2014

“A politically active nonprofit that spent more than $25 million on ads to help Republicans in the 2012 elections has stepped into a messy dispute between the government of Puerto Rico and a bank that claims the commonwealth owes it money — not something that fits neatly with the group’s activities in previous election cycles.

Doral Financial Corp., which has had financial and regulatory woes in recent years, sued the Puerto Rican government in June for voiding a 2012 agreement to pay the company nearly $230 million. The money is due as a tax refund in connection with Doral overstating its earnings from 1998-2005, according to a lawyer for the firm.”

“Doral hired a top Republican lobbying and PR firm, DCI Group, to help make its case earlier this year. DCI is well-known in GOP circles and to AFF, which previously contracted with a fundraising firm run by a former top executive at DCI.”

Puerto Rican Governor Attacks 'Far-Right' US Campaign

TeleSur, September 16, 2014

Opinion: Koch brothers eye Puerto Rico

December 2, 2014

F.B.I. Searches Doral Financial’s Offices in Puerto Rico

New York Times, by Michael Corkery, December 23, 2014

______________

2015

FEBRUARY Doral Bank taken by FDIC

JUNE Governor Alejandro García Padilla announces Puerto Rico debt is unpayable.

SEPTEMBER Marco Rubio publicly backtracks on H.R.870 bankruptcy bill for Puerto Rico, paving the way for PROMESA with a fiscal board as only way for PR to access bankruptcy court.

H.R.870 - Puerto Rico Chapter 9 Uniformity Act of 2015 114th Congress (2015-2016)

Marco Rubio Embraces The Koch Brothers’ Puerto Rican Priorities

September 4, 2015

“For months, the Kochs have been using their network affiliated groups — 60 Plus, American Future Fund, Cato, and others — to run a full court press lobbying campaign against access to Chapter 9 bankruptcy protection for Puerto Rico.”

Marco Rubio opposes bankruptcy lifeline for struggling Puerto Rico

Eyes on 2016, the junior senator opts to build conservative fiscal cred rather than favor within Florida’s Puerto Rican community.

Politico, By Hadas Gold, September 4, 2015

Some of Marco Rubio’s Wall Street/hedge fund donors:

Monarch Alternative Capital’s Andrew Herenstein

Joshua Friedman of Canyon Capital Partners

Peter Copses of Apollo Global Management

Lance Milken of Apollo Global Management

Laurence Berg of Apollo Global Management

Vineet Kapur of Fore Research & Management

Paul Singer donation to Super PAC

______________

2016

JUNE 29-30 U.S. Congress passes PROMESA, President Obama signs into law.

Public Law 114–187 114th Congress (PROMESA)

One of the best summaries of the 2014-2016 leadup in the Puerto Rico debt crisis and the passage of the federal PROMESA law that imposed an unelected 7-member board plus Natalie Jaresko on Puerto Rico.

Everything You Need to Know About the Proposed Federal Control Board for Puerto Rico

Latino Rebels, By Luis Gallardo, Apr 4, 2016

______________

2018

FDIC says LIBOR manipulation led to Doral Bank collapse

US FDIC sues 16 banks alleging Libor manipulation in Doral collapse

Business Insider, Feb. 20, 2018

“Doral Financial Corp, Doral Bank's holding company, filed for Chapter 11 bankruptcy protection in March 2015 to wind down its remaining operations two weeks after its Puerto Rico-based bank unit was seized by regulators.

The seizure of the bank was sparked in part by a refusal by the island's cash-strapped government to pay $230 million in tax refunds claimed by Doral Financial.”

FDIC sues 16 banks for actions harming Puerto Rico-based Doral bank

By Caribbean Business, February 21, 2018

“The FDIC’s action follows an ongoing lawsuit it filed in 2014 against the same large financial institutions accused of participating in a Libor manipulating scheme, including Bank of America Corp., Citigroup Inc., Credit Suisse Group AG and JPMorgan Chase & Co. The 2014 lawsuit alleged Libor manipulations had harmed 38 banks the FDIC had placed in receivership after they collapsed.

“Doral and the [FDIC]’s injuries arose from the harm to competition” as a result of Libor fixing by the large banks, the complaint said as quoted by MorningStar. “These injuries flow directly from the substitution of collusion for competition in the market for [over-the-counter] interest-rate derivatives.”

______________

______________

ADDITIONAL ARTICLES ON DORAL BANK:

Exploring the Manipulation Toolkit: The Failure of Doral Financial Corporation

Ahmed M. Elnahas

Eastern Kentucky University

June 18, 2016

“SEC investigations revealed several frauds related to Doral Financial Corporation’s valuation of interest only strips (IOs). However, our investigation shows that Doral management’s misconduct might have gone beyond IOs valuation to include reckless-hiring, over-investing, insiders trading, and possibly opportunistic stock splits. Further, it seems that manipulation through over-hiring and overinvesting, which was described in previous literature, is not totally random. Investigating the full range of corporate misconduct help reveal new tactics that managers possibly use to pool with good firms and might help advance our understanding of the economic impact of managerial misconduct.”

Last in Line in Puerto Rico’s Bankruptcy Fight for Everything

As part of Puerto Rico’s bankruptcy process, two committees represent retirees and unsecured creditors, which include public employees, teachers, government contractors and everyone who has monetary claims against the commonwealth government.

CPIPR (Centro de Periodismo Investigativo), Luis Valentín Ortiz, October 21, 2018

Shadow of Doral looms over bankruptcy

“Zolfo Cooper leads the financial consultancy of the UCC. It advises on the impact that fiscal plans and budgets approved by the government and the board will have on unsecured creditors, as well as on any debt-restructuring proposal. The New York-based firm adds more that $7.8 million to the bankruptcy’s professional service tab.

Zolfo Cooper worked on the liquidation of Doral Bank, a local financial institution that collapsed in 2015 amid serious financial woes. That same year, shortly before shutting down — and after the bizarre murder of one of its top officials — Doral sued the government to obtain, in cash, almost $230 million in tax credits it alleged it was owed by the local Department of Treasury, pursuant to a 2012 agreement between the Doral and the commonwealth government.

A few years later, several professionals from Zolfo Cooper related to Doral case are now advising as part of Puerto Rico’s bankruptcy process. This is the case of Enrique Ubarri, Doral’s former in house counsel and now senior adviser with Zolfo Cooper, providing services to the UCC at $850 each hour.

Last year, Ubarri and Doral Bank’s former chief executive officer, Glen Wakeman, signed a $14 million settlement with the FDIC for the federal agency to desist from taking action against both officials for alleged gross negligence in handling the operations of Doral.

Also part of the Zolfo Cooper team that worked in the Doral case and now advises the UCC are Scott Martínez and Carol Flaton, who was the bank’s main restructuring adviser and now leads the UCC’s financial consultancy, charging $940 each hour of her service. Jarett Bienenstock, son of the board’s lead legal adviser, Martin Bienenstock, works in Zolfo Cooper but is not involved in the Puerto Rico matter, the firm assures in a court filing disclosing his employment.

In late September, Zolfo Cooper announced that its operations will be acquired by AlixPartners, a restructuring firm that under the command of Lisa Donahue, served as lead restructuring adviser for the Puerto Rico Electric Power Authority during the administration of former Gov. Alejandro García Padilla.”

Defunct Puerto Rico Bank Resurfaces for Tax Fight

Shuttered in bankruptcy, Doral Financial lives to fight in Puerto Rico debt restructuring

Wall Street Journal, by Andrew Scurria, May 22, 2017

”A defunct Puerto Rico bank that closed its doors in 2015 over a bitter tax dispute isn’t done battling the local government yet.”

Parent of Puerto Rico's Doral Bank to liquidate in Chapter 11

Reuters, by Tom Hals, March 12, 2015

“Doral Financial Corp filed for Chapter 11 bankruptcy protection on Wednesday to wind down its remaining operations two weeks after its Puerto Rico-based bank subsidiary was seized by regulators.

…

The seizure of the company’s bank was sparked in part by a refusal by the island’s cash-strapped government to pay $230 million in tax refunds claimed by Doral Financial.”

Popular Acquires Certain Assets and Deposits of Doral Bank from the FDIC in Alliance with Other Institutions

Business Wire, February 27, 2015

“Popular, Inc. (NASDAQ:BPOP) announced today that Banco Popular de Puerto Rico (“BPPR”), its Puerto Rico banking subsidiary, acquired certain assets and all deposits (other than certain brokered deposits) of Doral Bank from the Federal Deposit Insurance Corporation (“FDIC”) as Receiver, in alliance with other co-bidders, including its U.S. mainland banking subsidiary, Banco Popular North America, doing business as Popular Community Bank (“PCB”).”

Doral Bank Fails After Years of Tumult

FDIC prematurely announced Puerto Rico lender’s failure

Wall Street Journal, Feb. 27, 2015, by Aaron Kuriloff and Ryan Tracy

“Doral Bank in Puerto Rico was closed by regulators Friday, with a botched announcement of its failure culminating years of turmoil that cost investors, including Goldman Sachs Group Inc. and Marathon Asset Management, hundreds of millions of dollars.”

“The FDIC said the banking operations for parent Doral Financial Corp. were sold to Banco Popular de Puerto Rico.”

“The sale cost the FDIC rescue fund, paid for by insurance premiums from banks, almost $750 million.”

“Doral’s failure was the fourth of a U.S. bank this year and the first in Puerto Rico since April 2010, when three firms failed. It was also the largest U.S. bank to fail since those Puerto Rican banks.”

“Doral’s problems began just before the financial crisis. Improper accounting forced Doral to restate earnings in 2006 with a 56% cut to profits. A $610 million recapitalization in 2007 by investors, including Goldman Sachs, Bear Stearns Merchant Banking and several hedge funds, failed to stabilize the bank.”

Puerto Rico's 3rd Largest Bank Fails

Zero Hedge, Feb. 27, 2015, by Tyler Durden

“And it seems the news of the FDIC Receivership leaked...What happened is that the FDIC "fatf-fingered" the failure realase just before the market close, with the stock plunging as a reulst, then promptly retracted the release but the damage had already been done. After the close, the FDIC re-informed the public that the bank, which back in 2010 traded at $125, had indeed been liquidated.”

Power, Politics and Journalism in Puerto Rico

Counterpunch, January 9, 2015, by Carmelo Ruiz-Marrero

“Daubón is on the global advisory board of the Foundation for Puerto Rico.

…

Other heavy hitters on the board include executives from Pixelogic, Doral Bank, Viacom and UBS, and two former USC presidents. The Foundation’s directors include Luis Alberto Ferré-Rangel, director of El Nuevo Día, and former Puerto Rico governor and San Juan mayor Sila Calderón.”

AFF Ad Campaign Highlights the New Argentina: Puerto Rico

Territorial Governor Padilla Continues Assault on U.S. Constitution, Investor Rights and U.S. Taxpayers

American Future Fund, July 29, 2014

“The American Future Fund (AFF), a national 501(c)4 organization, continues its advertising campaign warning on the unlawful actions of Governor Alejandro Padilla of Puerto Rico – a U.S. Territory – that puts at risk the U.S. Constitution and edges the Commonwealth ever closer tohemispheric rogue nation, Argentina.”

“In recent weeks, Governor Padilla and his government have undertaken a full-blown attack on the rule of law, the U.S. Constitution and investor rights. The first example, Doral Financial Corporation, a US-based bank and mortgage lender that Puerto Rico lawfully entered into a contractual agreement in 2012 acknowledging the Commonwealth owes Doral over $230 million. The agreement was ratified by both parties yet again in 2013. But Governor Padilla and his government are now refusing to honor this contract.”

San Juan Press Conference: Dr. Robert Shapiro to Release Analysis that Shows PR Government's Move to Nullify Its Agreements with Doral Financial Corporation Has Alarming Economic Implications

Marketwatch, June 23, 2014

Doral Financial Calls on the Puerto Rico Government to Honor Its Obligations

Yahoo Finance, May 15, 2014

“Accredited members of the press are asked to reserve space at the press conference by notifying Miriam Warren at mwarren@dcigroup.com. A copy of Dr. Shapiro's paper will be found at www.doralpuertoricofacts.com on the day of the release.”

Popular Inc seen as buyer of failed banks

April 5, 2010, By Anurag Kotoky

Cantor Fitzgerald Sees P.R. Bank Consolidation

Caribbean Business Online, March 11, 2010

Drexel University Lebow College of Business Class Notes

Lizzie Rosso ‘85, CPA, CTP, president of the Economic Development Bank (EDB) in San Juan, Puerto Rico, was featured in an article, “Lizzie Rosso: Small Businesses are the Heart of the Island’s Economy,” that was published in Caribbean Business. Governor Luis Fortuño selected Ms. Rosso to head the EDB in January 2009. Previously, Ms. Rosso served as senior vice president of Consumer Banking at Doral Bank. She was part of the team assembled by Doral Financial Corp. President Glen Wakeman to turn the bank around after confronting serious financial problems in 2006.

Indicted Ex-Doral Exec: Why Me?

Forbes, Mar 6, 2008, by Ruthie Ackerman

“Federal prosecutors allege that the former treasurer of Puerto Rico's largest mortgage lender (Mario S. Levis) committed fraud; he says he's only a scapegoat for the mortgage industry mess.”

“The U.S. Attorney's Office for the Southern District of New York accuses Levis of defrauding investors between 2001 and 2005 by manipulating the reported value of the company's core assets to artificially inflate the market price of Doral's common stock.”

“Following the settlement, Doral sold $610 million in stock at 63 cents a share to Doral Holdings, a newly formed company led by Bear Stearns.”

Doral Financial names Glen Wakeman president, COO

Marketwatch, May 30, 2006, by Michael Baron

Spanish language resources:

Durmiendo con el enemigo

El Nuevo Día, 19 de agosto de 2018, Por Nilsa Pietri Castellón

Se aplaza el pleito Doral vs Hacienda por falta de pruebas-VIDEO

Telemundo, 22 de julio de 2015

Doral Bank no recibirá reembolso de 229 millones dólares del Gobierno Puerto Rico

El Economista América, 26 de febrero de 2015

“Doral Bank no recibirá el reembolso de 229 millones de dólares que exigía a la Hacienda de Puerto Rico, según el dictamen del Tribunal de Apelaciones de la isla caribeña hecho público hoy y que puede suponer una sentencia de muerte para la institución financiera.”

Manifestación frente a Hacienda por caso de Doral

Califican como “asunto criminal” la negociación entre Doral Bank y los funcionarios de la pasada administración de Luis Fortuño.

Primera Hora, 11/10/2014

CEO (Glen Wakeman) de Doral no comparece a vista cameral

(CEO of Doral Bank, Glen Wakeman, a no-show at Puerto Rico legislature hearings on his bank’s agreement with former PR governor Luis Fortuño)

La citación es para indagar en el supuesto acuerdo realizado entre Doral Bank y la pasada administración de Luis Fortuño.

10/17/2014, Por Sharon Minelli Pérez

Doral niega vínculos con campaña contra gobierno de Puerto Rico

(Doral Bank denies links to American Future Fund ads in Wall Street Journal discrediting Puerto Rico governor)

Primera Hora, 09/16/2014

Refuerzo supremo para Doral en pelea con Hacienda

Noticel, Jun 20, 2014, por Aniel Bigio

Justicia no citará a Fortuño por Doral

Noticel, Jun 19, 2014, por Ely Acevedo Denis

La Demagogia de Luis Fortuño

La Verdad jamás podrá ser reemplazada por la Mentira, aunque la hagamos parecer una verdad.

por Prof. Pedro N. Gonzalez

________________

______________